The majority of churches are largely funded by their members, through generous giving and gifts. Churches also raise income through chargeable services, fundraising and trading to further their work.

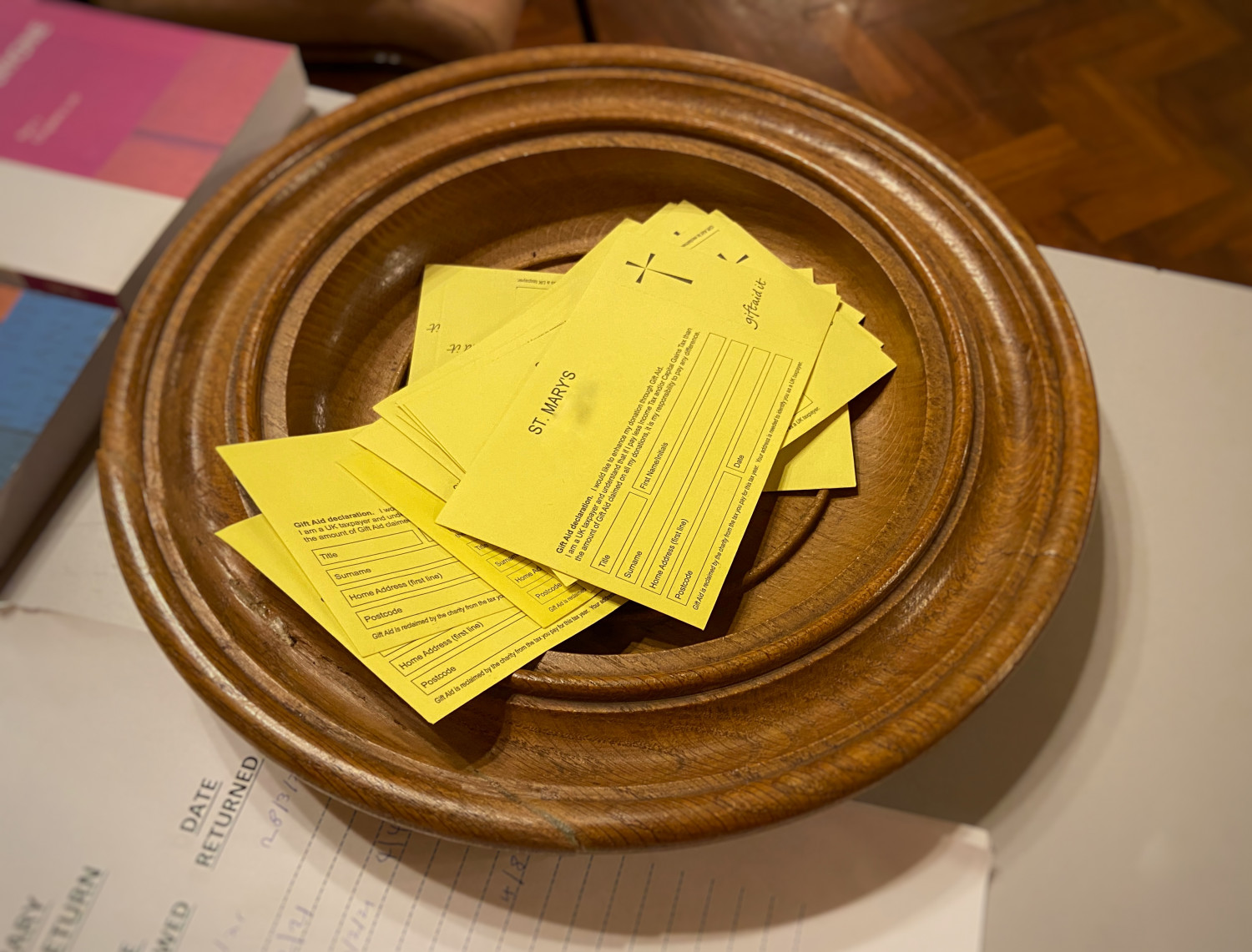

Generous Giving

Regular giving from committed Christian disciples is vital to ensure the continued presence of the Gospel message in our communities. For more information on giving please visit our Generosity and Giving pages.

PCC Fees

Churches are to charge a statutory fee for life events. Please see the latest fee guidance for more information.

Fundraising

Whilst day to day cost of running our churches are covered by regular giving, fundraising activities can help supplement income and fund larger projects.

A series of funding guides and practical help is available from the Parish Resources. Guides range from building projects to grant applications. Please visit www.parishresources.org.uk/resources-for-treasurers/funding/ for more information.

Ecclesiastical insurance has developed a range of resources to help churches fundraising and apply for grants. Please visit the ‘Fundraising Hub’ for more information.

Trading

Through church hall hire, bookstall and other ventures, parishes raise additional funds to support their mission and ministry. Trading is either ‘charitable’ or ‘non-charitable’ and all trading most be in the best interests of the church. Turnover may be subject to tax so do please see professional advice if your church is entering a trading venture. The Charity commission provide some helpful guidance see CC35: Trustee trading and Tax for more information.